|

Follow us on |

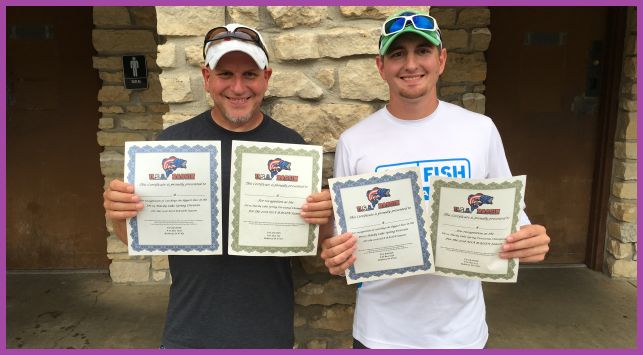

Latest News IN-05 Hardy Lake Spring Division Friday, July 27, 2018 Here's how they winners did it:

The team weighed in 22 fish during the season. Weighed in a total of 39.60 pounds. Their biggest fish for the season weighed-in at 5.40 lbs. They finished the season with 497 points and won the division over team of Jeffery Johnson / Andy Johnson by 53 points. Congratulations again to Richard Ison / Rich Ison for winning the Divisional Championship and good luck at the 2019 Lucas Oil Tournament Of Champions and in the Regional tournaments this fall . USA BASSIN want to thanks all the anglers that fished this division and wish them good luck in the Regional Tournaments this fall!!

National Sponsors

|

||

| © 2003 - 2025 U.S.A. BASSIN All rights reserved. | ||